If you were not already aware the October 2014 Stress Tests on banks across Europe identified 9 Italian banks (Only 9 I hear you say!) that were 'seriously' under financed, to the tune of €9.4 billion.

My name is Gareth Horsfall and I am the Manager of the Spectrum IFA Group in Italy. This blog is an extension of the services we provide for English speakers who live and/or work permanently in Italy. It is intended to be a ongoing guide on tax and financial matters. If you are interested in any of the content you can contact me on gareth.horsfall@spectrum-ifa.com or call me on +39 333 6492356 for further information. I am here to help!

Tuesday, December 9, 2014

Big Brother is coming to a bank near you!

An article that landed in my email inbox recently was about the OECD meeting on October 28/29th in Berlin:

Italy has joined another 53 countries to combat tax evasion by companies and individuals and has signed an agreement for an automatic exchange of financial information. Ministers from Spain, Germany, the UK, France and Italy met in Berlin with ministers from another 123 countries and signed the agreement

Switzerland has also signed up to the agreement to make information available on foreigners bank accounts. Once the ruling has gone through parliament it will be applied as of 2018.

We will shortly be seeing nothing other than automatic exchange of all the financial information on an annual basis, which the majority of jurisdictions have agreed to implement on a reciprocal basis with all other countries. The governments also agree to raise the standard level of information exchange when requested.

The Key points of the Agreement

The Bank account register

It will become obligatory as of 2016 to register all data of newly opened bank accounts and as of September 2017, the annual exchange of information will become routine. Austria and Switzerland will join the system in 2018. All data will be shared, including from 2017: bank balances, interest applied, dividends, income from investment products and tax identification numbers of all account holders who are receiving such income.

International cooperation

The global standard to be applied by the 54 countries and territories has been developed by the OECD in collaboration with the G-20 and the EC. It originated back in 2009, when the OECD started the movement which has enabled the collection of 37,000 million Euros in twenty countries.

Prosecution of crime and “engineering”

The agreement has a double objective: On the one hand to find and prosecute people who are trying to cheat the Tax authorities by hiding money abroad and on the other hand to avoid legal but dubious tax engineering by certain multinationals (who shall remain unnamed....but a popular fruit used in Cider, a coffee shop and a large search engine company spring to mind) who establish themselves in countries where they pay less tax.

The Global Forum on Fiscal Transparency and Exchange of Information.

Why is this important?

The latest OECD meeting effectively brings to an end the world of cross border banking confidentiality!

Italy has joined another 53 countries to combat tax evasion by companies and individuals and has signed an agreement for an automatic exchange of financial information. Ministers from Spain, Germany, the UK, France and Italy met in Berlin with ministers from another 123 countries and signed the agreement

As of 2016 all countries that signed the agreement will start to record the details of new bank accounts and, as of September 2017, they will start to exchange information on them as a matter of routine.

Details to be shared will include balances, interest applied, dividends, the proceeds of financial products and the account holder’s tax identification number.

Switzerland has also signed up to the agreement to make information available on foreigners bank accounts. Once the ruling has gone through parliament it will be applied as of 2018.

We will shortly be seeing nothing other than automatic exchange of all the financial information on an annual basis, which the majority of jurisdictions have agreed to implement on a reciprocal basis with all other countries. The governments also agree to raise the standard level of information exchange when requested.

The Key points of the Agreement

The Bank account register

It will become obligatory as of 2016 to register all data of newly opened bank accounts and as of September 2017, the annual exchange of information will become routine. Austria and Switzerland will join the system in 2018. All data will be shared, including from 2017: bank balances, interest applied, dividends, income from investment products and tax identification numbers of all account holders who are receiving such income.

International cooperation

The global standard to be applied by the 54 countries and territories has been developed by the OECD in collaboration with the G-20 and the EC. It originated back in 2009, when the OECD started the movement which has enabled the collection of 37,000 million Euros in twenty countries.

Prosecution of crime and “engineering”

The agreement has a double objective: On the one hand to find and prosecute people who are trying to cheat the Tax authorities by hiding money abroad and on the other hand to avoid legal but dubious tax engineering by certain multinationals (who shall remain unnamed....but a popular fruit used in Cider, a coffee shop and a large search engine company spring to mind) who establish themselves in countries where they pay less tax.

What is the impact on you?

I think that for the majority of expats in Italy this will have little impact other than to serve as an additional measure to ensure that what is reported each year is reported correctly. But, it does bring up another other question of whether your tax affairs are as tax efficient as they could/should be. There will no longer be room for error given that the information will be freely available to the authorities. There will be no possibility of backing out if wrong decisions have been made. For this reason I would reiterate, as always, that tax planning not just tax reporting is going to become more of a necessity.

If you have any queries on any of this subject matter or would like an initial discussion you can contact me on gareth.horsfall@spectrum-ifa.com or call me on cell: 0039 3336492356.

The Spectrum IFA group do not charge fees for initial consultations.

Wednesday, October 1, 2014

Withdrawal of UK personal tax allowance for NON UK residents.

I have been reading a lot recently regarding a proposal by the British government to remove the UK personal income tax allowance (£10000) for non UK resident landlords.

No nation has ever taxed itself into prosperity!

ITALIAN INHERITANCE TAX

You may not be aware but from an Inheritance tax point of view Italy is actually considered a bit of a fiscal paradise. (After you have picked yourself up off the floor because I just called Italy a 'fiscal paradise', you might want to read on). If your estate or part of it is likely subject to Italian Inheritance Tax on your death then the latest developments could interest you.

You may not be aware but from an Inheritance tax point of view Italy is actually considered a bit of a fiscal paradise. (After you have picked yourself up off the floor because I just called Italy a 'fiscal paradise', you might want to read on). If your estate or part of it is likely subject to Italian Inheritance Tax on your death then the latest developments could interest you.

Thursday, September 18, 2014

Expat Tax Grief

Not a week goes by these days, where I am not

contacted by someone who has a question about their residency in Italy, and

what that means for them fiscally. Either by people who are about to move to

Italy or others who have already been living here for some time and want to

become 'in regola'.

The conversation then naturally flows into the minutiae of exactly what are the taxes that need to be paid in Italy.

So, following on from my last blog post I thought I would write and explain those pesky taxes that apply to expats who have income being paid and/or assets held in other countries. I will repeat this towards the end of the year when some of you may be finalising your tax positions for 2014, but it may act as a good guide for those who are thinking about, or in the process of, doing something about their Italian tax returns for 2014.

The conversation then naturally flows into the minutiae of exactly what are the taxes that need to be paid in Italy.

So, following on from my last blog post I thought I would write and explain those pesky taxes that apply to expats who have income being paid and/or assets held in other countries. I will repeat this towards the end of the year when some of you may be finalising your tax positions for 2014, but it may act as a good guide for those who are thinking about, or in the process of, doing something about their Italian tax returns for 2014.

Wednesday, September 10, 2014

Resident Evil!

Tax Residency is always one of those issues that raises it head in batches, from time to time.

So, I thought I should clarify the matter again.

Tuesday, September 9, 2014

A Place in the Sun - Birmingham NEC 2014

For those of you who are familiar with the UK TV programme, A Place in the Sun, you may be interested to know that they also hold a twice yearly exhibition in the UK to promote home ownership abroad (and flog a few houses in the process).

The next one is in Birmingham from 3rd - 5th October 2014. I will be on a stand in the Italian forum doing a presentation on each of the 3 days to the attendees. The idea being, to try and advise expats before they move to Italy and help them to avoid the traps that many people fall into.

Our French team will be presenting in the France forum.

If you or anyone you know is in or near the Birmingham NEC on those dates and would like to attend I have some free tickets (Worth £10 each) and would be happy to send them on, if you just let me know by email on gareth.horsfall@spectrum-ifa.com

Wednesday, June 25, 2014

Rental Income from properties overseas and how to declare it in Italy.

One of

the questions I am asked regularly is how income from property held overseas is

taxed in Italy. Is it exempt from Italian tax because tax has been paid on

it overseas first and is it subject to the same taxes as Italian rental income?

I would

like to dispel any myth and confirm that you do have to pay Italian tax on the

profit from any rental income on properties held overseas as a resident in

Italy. (if it was really ever in doubt. Out of interest the arrangement is reciprocal, and any if you were resident in another country with rental property in Italy

then it need to be declared as well).

The best

way to organise your rental income

The law

for Italian tax residents states clearly that the net

profit (after expenses) from property overseas, must be declared in the Italian

end of year tax return. The net profit

is then assessed as income, added to the rest of your income for the year and

tax paid at your highest rate of income tax (that could be as high as 43%).

Let's not

forget the IVIE tax as well which is 0.76% of the property

council/cadastrale/rateable income (whatever you choose to call it) value of

the property.

If tax

has been applied in the country of origin, it is the law in Italy to declare

the funds here as well and so annual declarations need to be made.

As an

aside, it is relevant to note that in 2012 I received a deluge of enquiries

from people who had been contacted by the Guardia di Finanza who had obtained

information from HMRC (UK tax authorities) about people who have/had rental

properties in the UK, were legitimately declaring tax in the UK, but who had

failed to then declare that income in Italy. In some cases they were fined

substantial amounts for merely this simple mistake.

However,

all is not lost because there is a way to limit your Italian tax

liabilties. If the property income is

declared in the country of origin and all the costs are deducted from the

income, still within the country of origin, then ONLY the net profit needs to

be declared in Italy. In some cases it

might also be necessary to declare the rental income in the country of origin

even when that country no longer requires you to, for example the UK. If you

have rental income under the basic allowance of approx the first GBP 10500 of

income and therefore the UK no longer requires a declaration, it may still be

wise to insist on making a declaration because the UK allow for multiple

expense offsets for tax purposes. By

following this process you are showing the Italian authorities your expense

declarations and therefore it is acceptable for Italian tax purposes.

You may

in some cases be able to reduce your net profit to zero.

To

clarify, any rental income from properties held overseas must be declared in

Italy, for Italian tax residents. This

is the NET income (after expenses). And

this net figure is added to your other income to determine at which rate of

income tax it is assessed in Italy.

Depending on why you are investing in property overseas the advantages/disadvantages can work in 2 ways: .

1. If you

have high expenses for the property then it can work in your favour as a

capital appreciation investment. (assuming the value of the property goes

up). Less income means less tax.

2. The

downside of this arrangement is that someone with low expenses and high net

income (maybe living from the income in retirement) will be assesed at their

income tax rates in Italy (IRPEF) which could go as high as 43%

If you

are concerned about your tax situation in Italy and would like an initial

meeting to assess your liability then we are here to help. In addition, there might be other more tax

efficient and less costly ways to produce income and grow your money. If you are interested in exploring these then

you can contact me on gareth.horsfall@spectrum-ifa.com or on cell 333 6492356

Tuesday, June 24, 2014

CANCELLED! 20% Witholding Tax on transfers from overseas

Good news:

The law regarding a 20% withholding tax on overseas transfers of money in Italy was cancelled in the Spending

Review in April when Matteo Renzi came into power.

If you want to see a full article you can do

so (it is in Italian), click here:

For anyone bringing money in from overseas,

i.e pensions, income from employment, money from investments etc, you can rest

at ease knowing that 20% will NOT be with held at source when it enters

Italy.

There was a lot of pressure on Renzi when he

entered power to overturn this decree since it was administratively an enormous

burden on individuals, banks and other financial intermediaries and would have

been almost impossible to police. Beppo Grillo was quite outspoken about

the potential impacts on Italy and its ability to attract investment from

overseas if the law went ahead. I think he may have had a point, and

hence the reason it was repealed.

It will not be introduced in July and will not

be proposed (as things currently stand) in the near future. Italy will be

relying on agreements that are now in place with Spain, France, the UK, Germany

and the USA, to track movements of money from, to and within the aforementioned

countries. These bi-lateral share of information agreements are currently in

place and operating. The frameworks, under which they were originally

established, will also be rolled out to another 34 OECD countries within the

next few years.

Should you be unaware of this information,

then I hope it puts your mind at rest and you are able to enjoy the summer in

Italy, once again!

Monday, June 23, 2014

Plug the leak: Those expensive bank accounts.

During the course of my many conversations, one particular issue comes up all too frequently and which I thought I

just have to write about. It is something which has been on my radar for some

time now. Now the time has come.

What am I talking about?

I am referring to basic bank accounts that expats use in Italy, those bank accounts which were probably set up when you first moved to Italy, either because the person who you were buying a house from suggested you open an account at the same branch to make life easier, or you were referred to the local branch because most people used it, or someone knew someone who could open you an account when you may not have even been a resident at the time. I am sure these reasons may sound familiar to some of you.

But unfortunately, you are more than likely being charged an extremely high amount of bank charges for little to no service.

Monte Pashi di Siena.

What am I talking about?

I am referring to basic bank accounts that expats use in Italy, those bank accounts which were probably set up when you first moved to Italy, either because the person who you were buying a house from suggested you open an account at the same branch to make life easier, or you were referred to the local branch because most people used it, or someone knew someone who could open you an account when you may not have even been a resident at the time. I am sure these reasons may sound familiar to some of you.

But unfortunately, you are more than likely being charged an extremely high amount of bank charges for little to no service.

Monte Pashi di Siena.

nte Paschi di Siena keeps coming up as the worst culprit, by a

long stretch, but yet, seemingly used most frequently by the expats I meet. The person I met last

week was paying 34 euros a quarter for the bank account and then on 210 euro

transfers to another Italian bank account (a simple bonifico) a commission of

4.50 eur. (2% commission PHEW!).

I did not even get to see what they were paying for exchange rate conversions (the mind boggles) or transaction fees for taking money from the hole in the wall and other services.

I estimated the costs could be as high as 800 Eur a year.

But it is simply daylight robbery and too many of you could be getting ripped off (I have no better words for it I am afraid) because you think that 'it is just not worth the hassle of changing' or 'they are all alike' or 'banking back home is much better'.

However, this is no longer the case. Italian banks have really started to compete for business in the last few years and there are options available. If you are happy with internet banking, then even better.

I personally use 2 banks (personal and business). My personal account is Fineco. (who? I hear you say.). Fineco! (part of the Unicredit group). I am VERY satisifed with the service they offer. It is an exceptionally well operated online bank and even won the Global Finance Award for Best bank in Italy in 2013. It is 100% online. Now, I imagine that you might be thinking, online - Italy - errr, not sure, I need to keep an account where I can talk with someone if things go wrong. (My wife refuses to use the bank on that basis and she is Italian. She is slowly being brought around to my thinking). But, for basic banking it operates very smoothly. And I have emailed them many times and got reponses within 24 hours.

And the best part is, at the time of writing:

ZERO canone. In other words no monthly, quarterly, or annual charges just for having an account.

FREE withdrawals from ANY cash machine in the whole of Italy.

FREE credit card cash withdrawals from any Unicredit machines in Italy (and there are many).

ZERO cost bank transfers in Italy.

My other bank for the business is Banca Popolare del Commercio e dell'Industria. This does not mean much, but it is part of the larger UBI banca group network.

I chose this account at a branch as it is business account and I need to speak with my bank Director from time to time, but otherwise I operate everything online.

I pay only 5 EUR a month for this account and 0.50 Eur to make bank transfers. I can also withdraw cash from the UBI Banca group bancomats for FREE. The account, in general, is more expensive than the Fineco account but it is a business account and it has to be expected.

However, there are other personal account options with similar cost structures to Fineco, such as Ingdirect, Webank, Chebanca or Hellobank.

A good comparison website is www.confrontaconti.it

My simple message is to pay some attention to your bank account in Italy if you have not done so for some time. It is not difficult to change or use accounts, as in the past. With basic Italian you can do it without problem.

You could be making huge savings just through changing bank accounts. They are as easy to operate as online bank accounts abroad and , if in this persons case, a saving of 800Eur a year can be made then I would think it is definitely worth it. Any savings made can compensate for the increased taxes in recent years!

Take some time and have a look at your

old bank statements to see what charges you are paying and compare this on the

web link above to find out how much you 'could' be paying.

If you would like to know more about this or any other financial planning issues regarding living in Italy as an expat then feel to contact me on gareth.horsfall@spectrum-ifa.com or on cell 3336492356

Wednesday, June 4, 2014

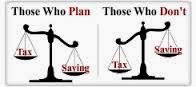

Tax reporting or TAX PLANNING!

I

know that you might, myself included, be waiting in anticipation for this

years Italian tax bill. So, whislt we wait I thought I would question what we doing

with our hard earned money. Is sufficient tax planning taking place or

are we mainly reporting the facts without paying sufficient attention to

whether we are making the most of the tax saving opportunities in Italy and

overseas?

I was recently asked by a prospective client, if I was a commercialista because it was not clear given that I write so much about tax and the changes in tax laws in Italy. The answer is NO, I am not a commercialista.

My basis for writing about the changes in tax laws is founded on 2 very simple principles. 1. I actually enjoy reading about it. 2. I believe that expats in Italy should know this information. Whilst it is quite freely available on the internet, it is a question of finding what is relevant to expat life in Italy and then translating it into a language you can understand so that it can be shared through this blog, by newsletter, word of mouth and also on the internet.

One of my other biggest concerns is that I hear, all too often, that commercialisti have incorrectly reported assets or do not understand the legislation relating to different overseas assets. I think it is important that people have a basic understanding of the tax laws in Italy before relying on someone else to make your tax declaration, which you are often then liable for if any mistakes have been made.

Which brings me back to the difference between tax reporting and tax planning.

Tax reporting is the process of providing your commercialista with information relating to your income and assets, once a year, which they report to the Italian tax authorities and, on which, your tax bill is prepared.

(Interestingly, I was speaking with a very successful, and now retired Australian friend in Perth when he was last in Italy. His advice was always to know your business/affairs and the tax laws surrounding it better than your accountant does. In his opinion, no accountant had never been proactive enough to help him reduce his tax bill or plan effectively and, in his opinion again, where they had offered advice it had often not been very good advice)

Tax planning is about looking for ways around the tax system/s (legally, of course) and trying to establish ways you can save money by restructuring your assets, taking advantage of the income tax rates, capital gains and losses, the pensioners tax credit, inheritance tax planning, and also establishing whether it is more tax advantageous to hold assets in one partners name or another. In essence, tax planning is a very important arm of financial planning. And that is exactly what I am. A financial planner.

A commercialista is not authorised to provide financial advice, by law. Their role is to take your financial information and make sure it is reported correctly. A good commercialista may spot some financial planning opportunities but would ultimately need to refer you to a financial planner to analyse the possibilities in closer detail.

As the reporting season for 2013 will soon come to a close, take note that if you think you might be paying too much in tax in Italy, or even overseas, then it is worthwhile looking at your financial affairs to see if you can structure them differently to make best use of the possible Italian and cross border tax opportunities that exist, or ways to pay less tax in the first place.

Tax planning is about looking for ways around the tax system/s (legally, of course) and trying to establish ways you can save money by restructuring your assets, taking advantage of the income tax rates, capital gains and losses, the pensioners tax credit, inheritance tax planning, and also establishing whether it is more tax advantageous to hold assets in one partners name or another. In essence, tax planning is a very important arm of financial planning. And that is exactly what I am. A financial planner.

A commercialista is not authorised to provide financial advice, by law. Their role is to take your financial information and make sure it is reported correctly. A good commercialista may spot some financial planning opportunities but would ultimately need to refer you to a financial planner to analyse the possibilities in closer detail.

As the reporting season for 2013 will soon come to a close, take note that if you think you might be paying too much in tax in Italy, or even overseas, then it is worthwhile looking at your financial affairs to see if you can structure them differently to make best use of the possible Italian and cross border tax opportunities that exist, or ways to pay less tax in the first place.

Wednesday, May 14, 2014

Umbria Expat - Financial Surgeries

Are you an expat living in Umbria and have some financial questions relating to living in Italy, which you would like to speak to someone about?

Examples might be:

How do the latest Italian Spending Review tax changes affect me?

What are my financial/reporting obligations as a resident in Italy?

How can I reduce the amount of tax I pay on savings and investments overseas?

What taxes do I have to pay on these in Italy?

What is the retiree tax allowance in Italy and am I eligible for it?

Are there other money saving opportunities that I can take advantage of in Italy?

If you would like to know the answers to these questions relating to life as an expat in Italy then I will be holding FREE, drop in, financial surgeries, in Umbria, on the following dates and times during the months of May and June 2014.

10:00AM – 1:00PM Friday 23rd May at Bar del Castello, Castiglione del Lago

10:00AM – 1:00PM Wednesday 28th May at Antico Caffè Giardino, Umbertide.

10:00AM – 1:00PM Tuesday 3rd June, Bar del Castello, Castiglione del Lago

10:00AM – 1:00PM Wednesday 11th June, Antico Caffè Giardino, Umbertide

10:00AM – 1:00PM Tuesday 17th June, Bar del Castello, Castiglione del Lago

10:00AM – 1:00PM Wednesday 25th June, Antico Caffè Giardino, Umbertide

Addresses: Bar del Castello, Viale Belvedere 1, Castiglione del Lago.

Antico Caffè Giardino, Via Garibaldi 14, 06019 Umbertide

There is ABSOLUTELY NO charge for this service

If you would like to take advantage of my availability on these dates then you can contact

me in advance on gareth.horsfall@spectrum-ifa.com or on cell: 3336492356

or

just pop along and feel free to pick my brains!

Thursday, April 24, 2014

20% withholding tax on foreign income remitted into Italy - almost banished!

I saw some great news regarding the proposed withdrawal of the 20% withhholding tax on income remitted from abroad into Italy. The law which could have been reintroduced again in July 2014.

Wednesday, April 16, 2014

Super Mario (Draghi's) game of risk

Mario Draghi's speech: He is finally talking about quantitative easing (QE) in Europe? How might it affect Italy?

Tuesday, April 15, 2014

UK Pension Changes - Budget 2014

The following summary of the UK Pension Budget changes, spring 2014 has been put together by The Spectrum IFA Group to assist you in understanding how the latest UK government changes to pension legislation may affect you.

Saturday, April 12, 2014

20% witholding tax on overseas transfer into Italy - UPDATE

I

would like to bring up the subject of the 20% witholding tax on profit from

investment, for Italian residents. This piece of legislation

that Italy was going to introduce in February and has now postponed until July 2014.

This seemed to be one of the main causes for concern amongst attendees at the

recent Tour de Finance Forum events in Italy and so I thought I would write the

little that I know of it to assist in preparation for its, possible, return.

Monday, March 3, 2014

Tour de Finance 'FORUM' 2014

The Tour de Finance 'FORUM' 2014

The Tour de Finance 2014 is back, but this time I have given it a twist!.

Every year we bring a group of financial experts on the road in Italy

to talk directly to expats about the financial considerations and concerns that

they are facing.

In 2014 we are returning to Bagni di Lucca and

Umbertide based on the interest shown and attendance in 2013.

We will be returning on the

26TH MARCH 2014

Umbertide at Ristorante Pomarancio

http://www.ristorantepomarancio.it/

27th MARCH 2014

Nr Bagni di Lucca at La Cantina delle Pianacce (Ghivizzano)

http://www.lacantinadellepianacce.it/

Nr Bagni di Lucca at La Cantina delle Pianacce (Ghivizzano)

http://www.lacantinadellepianacce.it/

Start time: 10.30am for coffee and sweets until approx 1pm with a FREE buffet lunch, wine and an opportunity to meet your fellow expats.

(I would like to add that due to increased demand for our services, we are receiving requests from all over Italy and so we want to extend the Tour de Finance into other parts of the country. So we will not be returning to these same locations for at least 1 year as the Tour de Finance is planning to expand to others areas of Italy in the autumn 2014.)

BUT, this time the format will change!

We are doing away

with the Powerpoint presentations and structured presentations!

After reflecting on your feedback from previous events, I have decided to change the format to a FORUM style event. I want to avoid presenting all the information that 'we think you should know' and actually try and deliver the information that you want to know. Typical questions that I often hear from people include:

What are the likely implications of the recent implementation and then

withdrawal of a 20% witholding tax on profit from investments held overseas,

for Italian residents?

Are there opportunities to reduce my Inheritance tax liabilities in Italy?

What risk is there of losing all my money when I invest and how can I avoid this completely?

Are there any tax allowances/credits available to me as a resident in Italy?

So I, Gareth Horsfall (Spectrum IFA group (Italy) will pose questions to the panel for approx 30 minutes, followed by a refreshment break and then a further 30 minutes for questions from the audience.

It really is an opportunity to put the experts 'on the spot'

The Panel of experts will include:

Judith Ruddock: Studio Gaizo del Picchioni.

Cross border

tax specialists and commercialisti.

Andrew Lawford: SEB Life International.

He will be facing questions about tax efficient

savings vehicles for Italy and ways to potentially reduce your Inheritance tax

liabilties.

Rob Walker from

Jupiter Asset management, Private Clients. He will be free to take questions

on world markets, from the current state of emerging markets to how to generate

income from your money.

And finally Peter Loveday from

Currencies Direct . He will be taking questions on how to save money on

International currency transfers and how they work.

I hope you will register your attendance. And I hope that the FORUM event will avoid all the boredom of powerpoint presentations and make the morning much more interactive for you.

If you would like to register for this event then you can do so by sending your full contact details to info@spectrum-ifa.com or call Gareth Horsfall on 0039 333 6492356.

Thursday, February 20, 2014

Sunday, February 16, 2014

Breaking News: 20% witholding tax on transfers from abroad into Italy.

As of February 1st 2014 banks in Italy will be obligated to withold 20% of the amount relating to transfers coming into personal accounts from abroad. The 20% will be witheld at source, by the bank, and unless an exclusion has been applied for it will be up to the tax payer to prove that the money is not 'income' from financial transcations abroad.

Investing for a higher income

Investing for income, rather than capital

appreciation, is as old as investing itself but its relevance becomes more

noticeable in times of low bank interest rates. (Or historically low as the

media likes to keep reminding us).

Friday, January 10, 2014

Minimum reporting threshold for funds held abroad - clarified!

Property rentals in Italy - Goodbye cash 2014!

From 2014 owners of properties in Italy, which they rent, will be expected to have the rent paid only through trackable methods of payment.

Subscribe to:

Posts (Atom)