|

The current

political environment in Italy is one which I find very interesting,

notably in how it is perceived in foreign media and presented to us through

the usual media outlets.

In, I reference the constant use of the word

'Populism' and 'Populist Government'. I confess that I had to have a

quick look at the definition of populism before writing this blog and was

interested in finding out that the exact definition, according to Wikipedia,

is:

'Populism is a political philosophy supporting the rights and power

of the people in their struggle against a privileged elite'

I have a confession to make that if I can pick and choose only

this broad definition of Populism then I think I can fit myself into a

part of the populist ideal. (Clearly it is more complicated than this,

but I am merely trying to make my point, and as a regular reader of my blogs's

you will understand my usual approach!)

However, I think it is worth exploring the idea that the Lega and M5S

coalition have put together of a flat tax. Although a flat tax for everyone,

no matter how rich or poor is completely obscene in my opinion

the 'flat tax', proposals, which will launch at 20% for businesses as

of July 1st 2018 and 15% - 20% on 1st Jan 2019 for individuals,

assuming the Government holds together, actually make a lot of sense to

me.

A radical reform of the Italian income tax system is about to take

place, and one which is long overdue in my opinion. Not for any

populist reasons, but for more practical reasons which I will expand

on below.

The proposed flat tax regime

If you want to have a look at the Contratto per il Governo di Cambiamento,

then you can do so HERE.

It makes interesting reading, if not full of more blurb than actual

facts at this stage. However, it’s a start.

So, going back to the issue of the flat tax. The proposal, soon to be put

into force, is to reform the tax regime into 2 flat tax rates,

namely 15% and 20%. This sounds very new and certainly will win a

lot of those populist votes. But first let's take a look at how

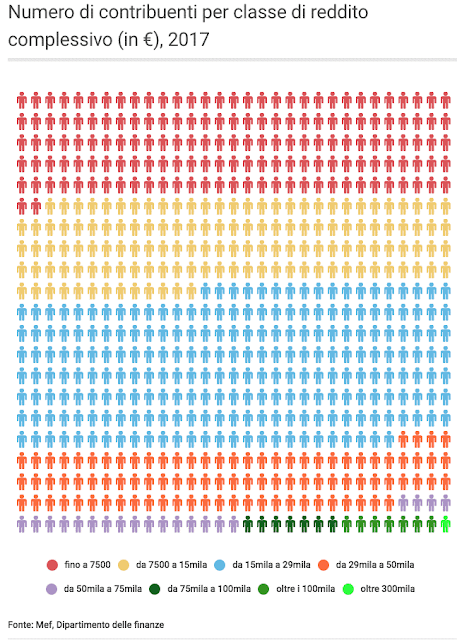

income is currently spread in Italy and the following chart shows just who

it would affect:

It's quite interesting to note from this chart that 80% of the

tax paying population of Italy earn up to €29000. The median declared

income is €19000pa. Those may sound strange numbers

but when you consider the current Italian tax rates (see chart below),

you can start to form an idea that there is probably a little bit of

fiddling of the figures. After €28000pa in reddito

complessivo the tax rate jumps from 27% to 38%. With

this in mind, the proposal of a flat tax could potentially bring in alot

of, currently, undisclosed (let's call it what it really is: 'in

nero') money to the Government coffers.

|

No comments:

Post a Comment