In this blog I want to look at what has

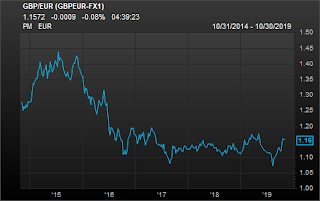

happened to sterling since Brexit and the outlook. In 2015, when the

world seemed a lot more secure, GBP v EUR was trading over 1.40 and life

seemed good. Anyone holding GBP based assets

and incomes would find that their money went a long way. Today it is

trading at 1.17.

With all this confusion it inevitably causes some uncertainty. This seed

of uncertainty has shown itself nowhere better than in the continued

daily swings of GBP v EUR.

It has been a while since my last E-zine. I am sure that it won't go

unnoticed that this E-zine is coinciding with the UK general election on

December 12th. At the present time the Conservatives are polling for a

small majority, but it would seem to be anyone's

guess as to the ultimate result.

A RECENT HISTORY OF STERLING

Around the

start of 2016, after the Brexit fuse had been lit, sterling started to

fall as the Leave campaign gained ground and the markets reacted

nervously to a potential Leave outcome.

Immediately after the Referendum, June 24th 2016, when the result was announced, GBP fell the most against a world basket of currencies since the introduction of free floating currencies in 1970. On June 24th 2016 it had it's largest ever one day fall of 13%. To put this into context, when George Soros famously 'broke the Bank of England', and made billions by betting against sterling in 1992, resulting in its subsequent ejection from the exchange rate mechanism, sterling only fell by 4.3%. In 2009 at the height of the financial crisis sterling lost 16% but over an 11 trading day period between 8-23 September 2009. The Brexit effect was huge.

I remember calling some currency brokers in the City of London early in the morning of June 24th 2016 and asking what was happening on the trading floor. The only responses I got were "fortunes have been made this morning!" and "it's chaos over here".

Roll on 2019 and as you will see from the charts below, since 2017, after the drop, sterling has traded within a range of values and has only experienced a 'relative' peak around the middle of this year.

Immediately after the Referendum, June 24th 2016, when the result was announced, GBP fell the most against a world basket of currencies since the introduction of free floating currencies in 1970. On June 24th 2016 it had it's largest ever one day fall of 13%. To put this into context, when George Soros famously 'broke the Bank of England', and made billions by betting against sterling in 1992, resulting in its subsequent ejection from the exchange rate mechanism, sterling only fell by 4.3%. In 2009 at the height of the financial crisis sterling lost 16% but over an 11 trading day period between 8-23 September 2009. The Brexit effect was huge.

I remember calling some currency brokers in the City of London early in the morning of June 24th 2016 and asking what was happening on the trading floor. The only responses I got were "fortunes have been made this morning!" and "it's chaos over here".

Roll on 2019 and as you will see from the charts below, since 2017, after the drop, sterling has traded within a range of values and has only experienced a 'relative' peak around the middle of this year.

STERLING CHART 2015 TO 2019

STERLING CHART 2017 TO 2019

WHAT DOES THE FUTURE HOLD FOR GBP V EUR?

In my travels around Italy to talk to

clients this is the most asked question. Since the highs of 2015, there

has been an approximate 20% loss in the value of your GBP assets and

incomes. For anyone living on a fixed income,

i.e. pensions or living from assets, this is starting to have an

effect. In the past year the number of clients asking to top up their

income from their assets has increased. This withdrawal effect

represents a net reduction in your overall asset base, when

that money might have been spent on future medical needs, inheritance

for children, or just for future living costs.

Therefore, it is no surprise to me that I am asked frequently for my opinion on the matter, and additionally whether you should be thinking about converting assets into euro, to hedge against further falls.

Therefore, it is no surprise to me that I am asked frequently for my opinion on the matter, and additionally whether you should be thinking about converting assets into euro, to hedge against further falls.

MY RESPONSE

I have been speaking to asset managers in London and currency specialists over the last year about this subject to try and get a feel for the 'word on the street'. I can tell you that the theme has always been the same and nearly all asset managers say the same thing. Sterling is desperately undervalued if we measure it against the fundamentals such as productivity of the economy, GDP v debt etc. Very simply, this means that when compared against all measures, sterling should be trading quite a bit higher against the Euro. The uncertainty surrounding Brexit is depressing the value more than anything else, rather than the actual event itself.

The rational thinking is that the currency markets, at this point in time: 3 years after the vote, are desperate for an outcome, whether that be a deal or remain (we cannot exclude no-deal, but for now it appears to have been put to rest). If we are to assume that the Conservatives win a majority (no matter how small) then there could be a bounce in sterling in anticipation that Boris Johnson's deal is likely to be passed in parliament and provide the certainty that the financial markets are desperately searching for. The deal being passed 'could' create conditions for 'another rimbalzo' in the price of sterling. My guess is that it would bounce quickly after any decision was taken, although these are only educated guesses.

You may now be thinking, 'how much would it likely rise?'. Well, if I

knew that then I would be a very rich man indeed. In all honesty, no one

can say for sure. I am not a betting man but I wouldn't be looking to

place any sizeable

bets on it even if I were.

I remember that at The Spectrum IFA Group annual conference in January this year in Portugal, we had a speaker, David Coombes from Rathbones Asset Managers. He gave his outlook for sterling based on the 2 parameters he had set for the fund he manages. In the event of no deal he had GBP/EUR at 0.9 and in the event of a return to remain he placed GBP/EUR at 1.4. He went on to say that for any scenario in between you can pick your own point.

Going further in my own assessment of things, I personally think that if a deal is passed, or remain wins (in my dreams), then sterling is going to rise, but by how much I wouldn't like to say. However, we must remember that 'getting Brexit done' is a illusion in itself. Passing a deal in parliament is only the start. The UK then has to formally leave the EU and start negotiating trade deals around the world. Some will likely fall in place very quickly, Canada, Australia, South Africa, maybe even the USA, but the deal with the EU and important future trade deals with India, China etc will likely take years and may not be as good as Brexiteers might hope for.

To give you an example of how difficult these trade deal negotiations might be, let's take the example of Switzerland versus China and their trade deal which they struck in 2013. Everyone is aware of the rapid growth of the Chinese economy and how almost every nation in the world would like to strike a free trade deal with China to access the billions of growing middle class individuals and a rapidly growing consumerist economy. Switzerland is one of very few countries outside the Asia Pacific region to do so. However, Switzerland had to make some large sacrifices to get that deal, mainly that the Chinese negotiated FULL and free access to the Swiss economy for a period of 10 years during which time Switzerland would have only very LIMITED access to certain sections of the Chinese economy. The Swiss deemed this to be a good deal! It just goes to prove that deal making around the world is not going to be as easy as the Leave campaign would like us to believe.

Any protracted deal making phase may well be a negative effect for sterling and after any initial bounce on the back of some certainty, you might see sterling enter a volatile period once again, certainly as the unravelling from the EU also takes effect. I don't buy into Project Fear and think that the UK will find its way in the world outside the EU, but like any divorce it will get messy for some time. The question is for how long and what impact will this have on the currency.

I remember that at The Spectrum IFA Group annual conference in January this year in Portugal, we had a speaker, David Coombes from Rathbones Asset Managers. He gave his outlook for sterling based on the 2 parameters he had set for the fund he manages. In the event of no deal he had GBP/EUR at 0.9 and in the event of a return to remain he placed GBP/EUR at 1.4. He went on to say that for any scenario in between you can pick your own point.

Going further in my own assessment of things, I personally think that if a deal is passed, or remain wins (in my dreams), then sterling is going to rise, but by how much I wouldn't like to say. However, we must remember that 'getting Brexit done' is a illusion in itself. Passing a deal in parliament is only the start. The UK then has to formally leave the EU and start negotiating trade deals around the world. Some will likely fall in place very quickly, Canada, Australia, South Africa, maybe even the USA, but the deal with the EU and important future trade deals with India, China etc will likely take years and may not be as good as Brexiteers might hope for.

To give you an example of how difficult these trade deal negotiations might be, let's take the example of Switzerland versus China and their trade deal which they struck in 2013. Everyone is aware of the rapid growth of the Chinese economy and how almost every nation in the world would like to strike a free trade deal with China to access the billions of growing middle class individuals and a rapidly growing consumerist economy. Switzerland is one of very few countries outside the Asia Pacific region to do so. However, Switzerland had to make some large sacrifices to get that deal, mainly that the Chinese negotiated FULL and free access to the Swiss economy for a period of 10 years during which time Switzerland would have only very LIMITED access to certain sections of the Chinese economy. The Swiss deemed this to be a good deal! It just goes to prove that deal making around the world is not going to be as easy as the Leave campaign would like us to believe.

Any protracted deal making phase may well be a negative effect for sterling and after any initial bounce on the back of some certainty, you might see sterling enter a volatile period once again, certainly as the unravelling from the EU also takes effect. I don't buy into Project Fear and think that the UK will find its way in the world outside the EU, but like any divorce it will get messy for some time. The question is for how long and what impact will this have on the currency.

MY ADVICE

In summary, if you have money in

sterling and ask me for advice, I will say that you should not convert

it into euro right now. I will caveat that with the fact that neither I

nor the best currency expert in the world can tell

you what will happen, but it is a reasonable assumption that sterling

will rise when the next steps of Brexit are resolved one way or the

other. What happens after that is anyone's guess. If you need to convert

to euro then I would suggest doing so in tranches,

or holding on until after Dec 12th to see what happens. Then pick your

time, keep an eye on the rate and convert on the peaks.

(I am adding this note after having completed this E-zine. Our rep from Currencies Direct, our preferred currency exchange partner, called me about 5 minutes after completing this text and we had a chat about GBP expected movements in relation to the elections. She said that they are thinking that GBP v EUR could bounce to the mid 1.20's if Boris Johnson wins the election with a majority. This is not a prediction, merely a hypothesis!)

(I am adding this note after having completed this E-zine. Our rep from Currencies Direct, our preferred currency exchange partner, called me about 5 minutes after completing this text and we had a chat about GBP expected movements in relation to the elections. She said that they are thinking that GBP v EUR could bounce to the mid 1.20's if Boris Johnson wins the election with a majority. This is not a prediction, merely a hypothesis!)

No comments:

Post a Comment